COMPENSATION DISCUSSION AND ANALYSIS (CD&A)

In the CD&A, we describe and discuss our executive compensation program, including its objectives and elements, as well as determinations made by the Compensation and Human Capital Committee regarding the compensation of our named executive officers (“NEOs”). Below is a condensed table of contents to help guide you through the CD&A section of this proxy statement:

- Executive Overview (pp 33) - Executive Compensation Decision Making (pp 37) - Our

Named Executive

OfficersCompensation Program (pp 38) | | | | | | | | | | | | | | |

| Joseph Hamrock

President and CEO

| | | Donald E. Brown

Executive Vice President (“EVP”), CFO and President, NiSource Corporate Services (“NCS”- Executive Compensation Elements (pp 39) - Executive Compensation Process and Guidelines (pp 47) | | | Carrie J. Hightman*

EVP, Chief Legal Officer (“CLO”) and CEO of Columbia Gas of Massachusetts (“CMA”)

| | | Violet G. Sistovaris

EVP and Chief Experience Officer

| | | Pablo A. Vegas

EVP, COO and President, NiSource Utilities

| |

*

| Ms. Hightman separated from the Company on January 29, 2021. |

2020 Business DevelopmentsOur Named Executive Officers (NEOs)

As of December 31, 2022, the NEOs are:

Lloyd Yates —President and AccomplishmentsChief Executive Officer (“CEO”)

Fiscal 2020 was an important transitional yearDonald E. Brown—Executive Vice President and Chief Financial Officer (“CFO”)

Shawn Anderson—Senior Vice President Strategy and Chief Risk Officer

Melody Birmingham—Executive Vice President and Chief Innovation Officer

Bill Jefferson—Executive Vice President and Chief Safety Officer

Joseph Hamrock—Former President and Chief Executive Officer

Pablo A. Vegas—Former Executive Vice President and Group President, Utilities

On March 15, 2023, we announced a reconfiguration of leadership responsibilities for several of the Company. We keptabove named NEOs, effective March 27, 2023. Please see our annual report or our website for further details.

Our Company

NiSource is one of the largest fully regulated utility companies in the United States, serving approximately 3.2 million natural gas customers and 500,000 electric customers across six states through its local Columbia Gas and NIPSCO brands. Based in Merrillville, Indiana, NiSource’s approximately 7,500 employees are focused on safely delivering reliable and affordable energy to our customers and the communities we serve.

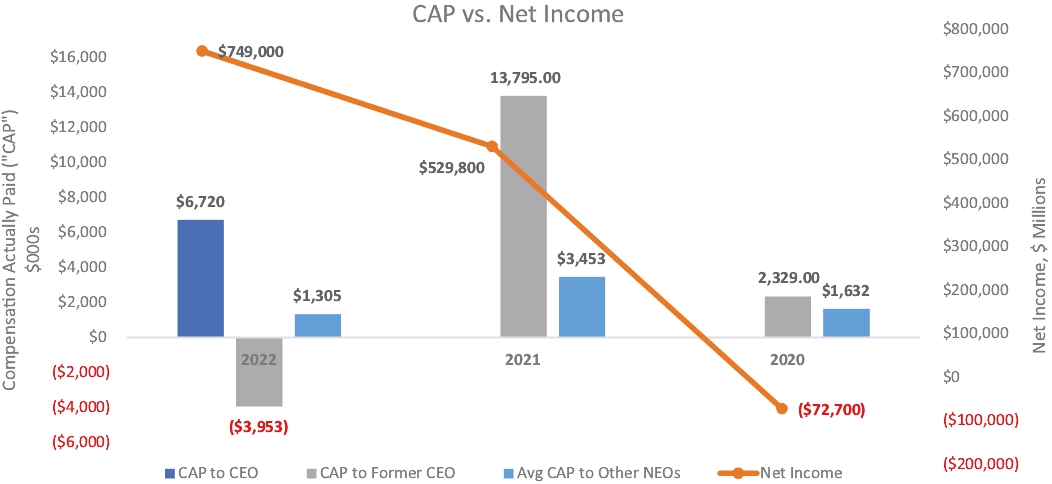

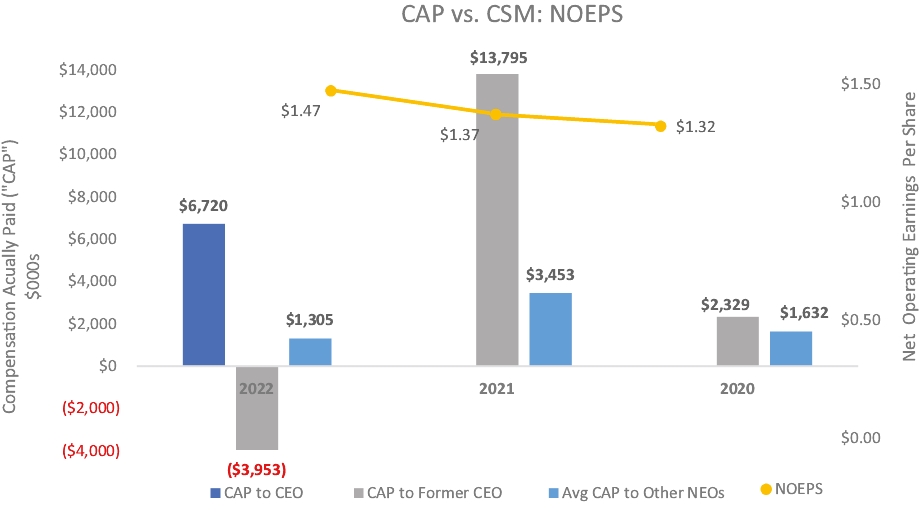

Our strategies focus on execution despite the backdrop of COVID-19improving safety and the sale of the CMA business. This focused execution drove continued investmentsreliability, enhancing customer service, pursuing regulatory and legislative initiatives to increase accessibility for customers currently not on our gas and electric service, ensuring customer affordability and reducing emissions while generating sustainable returns. With our strategies in our asset modernization programs, enhanced our implementation of a safety management system across all of our operating companies, and advanced our transitionmind, NiSource is committed to renewable energy generation. Throughout the year, we responded to our customer and community needs as relentless champions of safety, service and comfort. Our operating companies maintained their commitment to deliveringproviding safe and reliable utility service, while supportingenergy for our customers, throughwhich in turn creates value for our stockholders. Our executive compensation program is intended to attract and retain the challenges of COVID-19 by suspending shut offs, stopping late fees and offering additional flexible payment plans.

Followingbest leadership talent in the closing of the CMA transaction in October, we repositioned our leadership and launched a Company-wide, multi-year initiative to enhance efficiencies and reduce overhead costs as we propel our safety and modernization strategies forward (“NiSource Next”).industry. At the same time, we continued to execute on our environmental, social and governance (“ESG”) strategies, which along with NiSource Next, arecompensation program is designed to deliver sustained value overalign our executives to achieve these critical commitments.

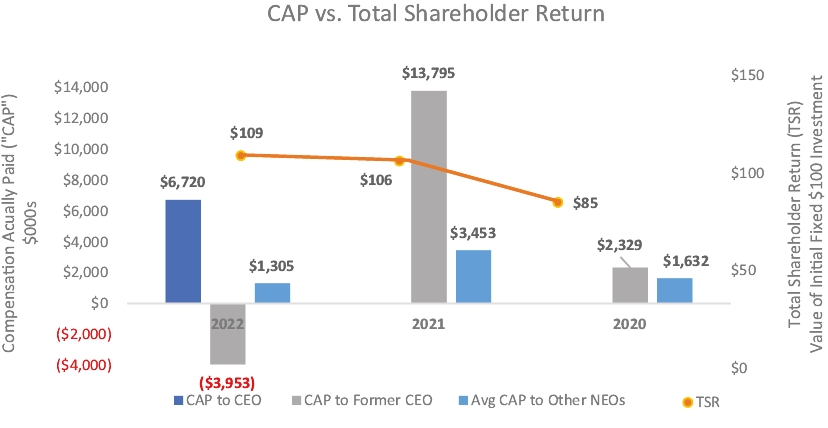

Leadership Enhancements In 2022

2022 was a year of continued transition for NiSource. Following the long-term to all our stakeholders, including our customers, communitiesplanned retirement of former CEO and employees.

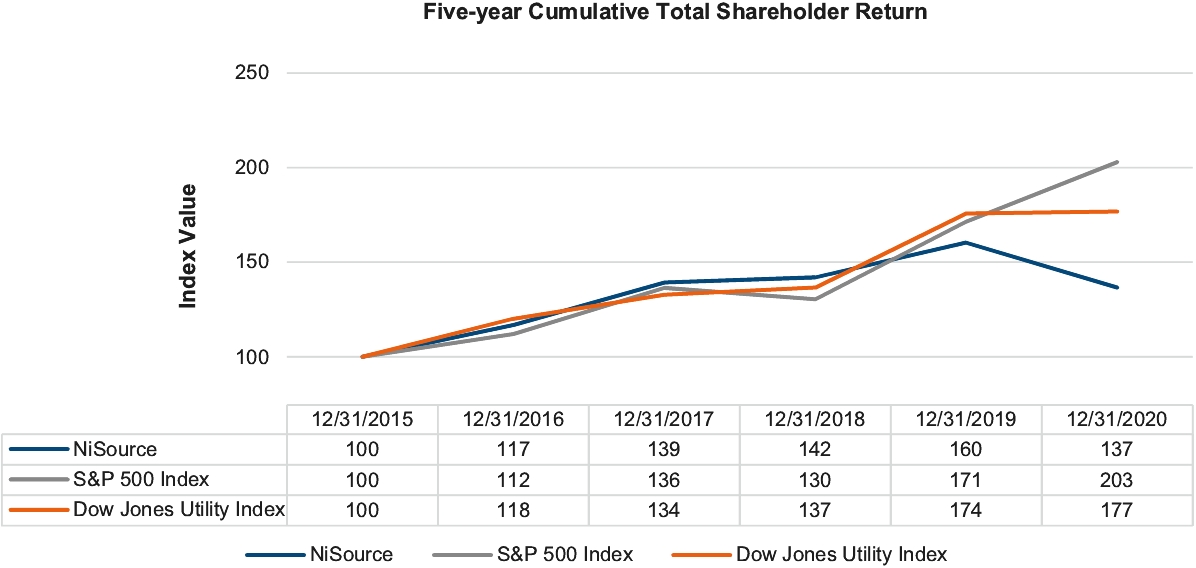

Despite significant transitionalpresident Joe Hamrock, the company appointed Lloyd Yates as CEO and operational achievementsPresident, assuming these roles on February 14, 2022. Mr. Hamrock assisted in 2020, our performance resultsfacilitating the CEO transition in a non-executive officer role and stock price were significantly impacted by COVID-19 and the effect of the sale of the CMA business. This resulted in declines in executive pay for 2020 as compared to 2019, as reflected by our short-term cash-based incentive program (“STI”) and performance-based stock unit (“PSU”) incentive program results. For illustrative purposes:resigned effective July 31, 2022.

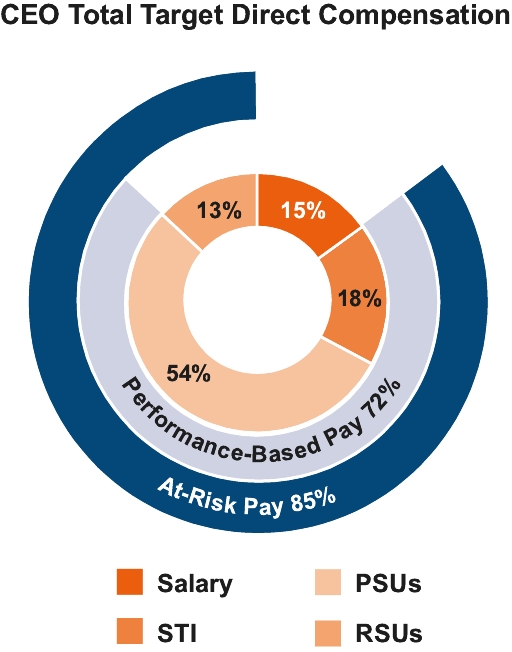

■ | Our 2020 STI program paid out at 40% of target, as compared to an STI payout at 62% of target in 2019

|

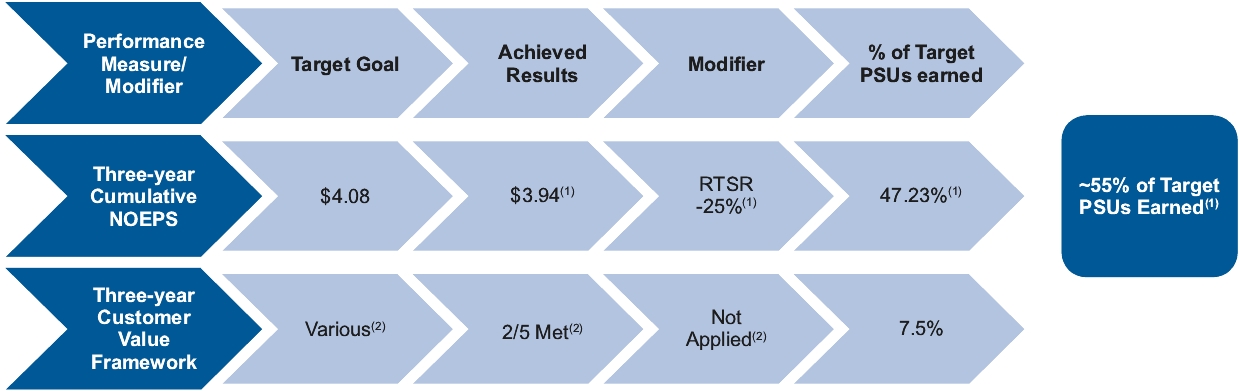

■ | Our 2018 PSU program that vested based on performance through December 31, 2020 and continued service through February 26, 2021, paid out at a vesting level of approximately 55% of target, as compared to a vesting level of 100% of target for the PSUs that vested based on performance through December 31, 2019

|